Last year, not only Pakistan but the whole world was in the grip of economic, social, political and democratic crisis due to the global epidemic of Covid-19. Even today, many of the people in the world is infected with the corona virus, which has shaken our political, social, administrative, psychological and economic structures.

This epidemic has shown us a time that has never been seen before in history. Significantly, the corona virus came at a time when the world has learned a lot.

The world is interconnected by modern technology. Importantly, the corona virus attack has exposed the economic, social and administrative capabilities of the world's largest countries. It has revealed to everyone how much ability they have to deal with any major accident and how they can save themselves from these accidents. Champs Write is monitoring the overall impact of Covid-19.

The International Monetary Fund, the IMF and the World Bank have also been forced to think that extraordinary measures should be taken for developing countries. Consideration was also given to repayment of loans for all these countries and recourse to guidelines for concessional loans.

All the poor countries are currently looking at the global financial world. The tragedy is that the big countries themselves fell victim to the coronavirus and their own economic systems collapsed.

Pakistan's economy, like the rest of the world, has been hit hard by the epidemic. The first case of corona virus in the country was reported on February 26, 2020. By March 10, the number had risen to 454. As of March 25, the number of patients had risen to 991. Then in just one month, the number of patients had reached thousands. Champs Write reported.

In view of this situation, with the implementation of lockdown in the country, it was made necessary for everyone to wear a mask, keep a social distance of 6 feet and avoid shaking hands. It was not easy for the Prime Minister to decide on a lockdown or shutdown in the country. laborers on daily wages and those whose livelihood depended on daily economic activities were in view.

A large part of the society provides for their livelihood from the routines of the economy which are related to earning and eating daily. Workers, shopkeepers, salesmen, distributors, transporters and peddlers earn their living as part of the economic machine. It was possible that there would be famine among these people.

In the same life-and-death struggle, the corona virus has paralyzed the country's economic machinery. Fortunately, the decision to lockdown initially proved to be the first step for the government of Pakistan, which was appreciated all over the world.

Saudi Arabia, realizing the reality of the corona virus, has taken all possible steps to prevent human gatherings, including the temporary delay of Umrah and Tawaf. That is why in 2020, Muslims all over the world, including Pakistan, will be deprived of Hajj. In the wake of the rapid spread of the coronavirus, neighboring India initially carried out a full 21-day lockdown with astonishing speed.

More than 80% of the world's flights were canceled. Due to the rapid spread of the corona virus in our country, all foreign and domestic flights, trains and public transport were shut down, causing an irreparable blow to the economy.

At the national level, one of the major concerns was how we could save our economy, and another was how and to what extent relief could be provided to the underprivileged during the lockdown. Champs write raised this question. This was no less of a test for the PTI government as it set out on a path of development based on a transparent and fair policy in restructuring the country's economic and social structures.

In this national crisis of Corona, on the one hand, the government is working hard to deal with Corona and revive the economy, the state, the government and its affiliated organizations and NGOs in their limited resources with good or bad potential. They are also trying to do good, but in spite of all these circumstances, where are our political parties now? Political parties, whether in government or in opposition, are the real inheritors of the political system.

A large number of people are associated with political parties, their leadership and political activists. One of the main slogans of political parties is democracy, human rights, including real justice and a society based on justice. The Corona crisis cannot be dealt with by the government alone.

Instead of supporting the government in these circumstances, the three major opposition parties, the Noon League, the PPP and the JUI-F, formed an anti-government coalition, the Pakistan Democratic Movement (PDM) and held rallies in various cities from October 2020. These public meetings dispersed the SOPs about Corona.

The government said the opposition should postpone its meeting for three months in view of the rapidly rising cases and deaths in the second wave of Corona. But this trend was continued by the Pakistan Democratic Movement.

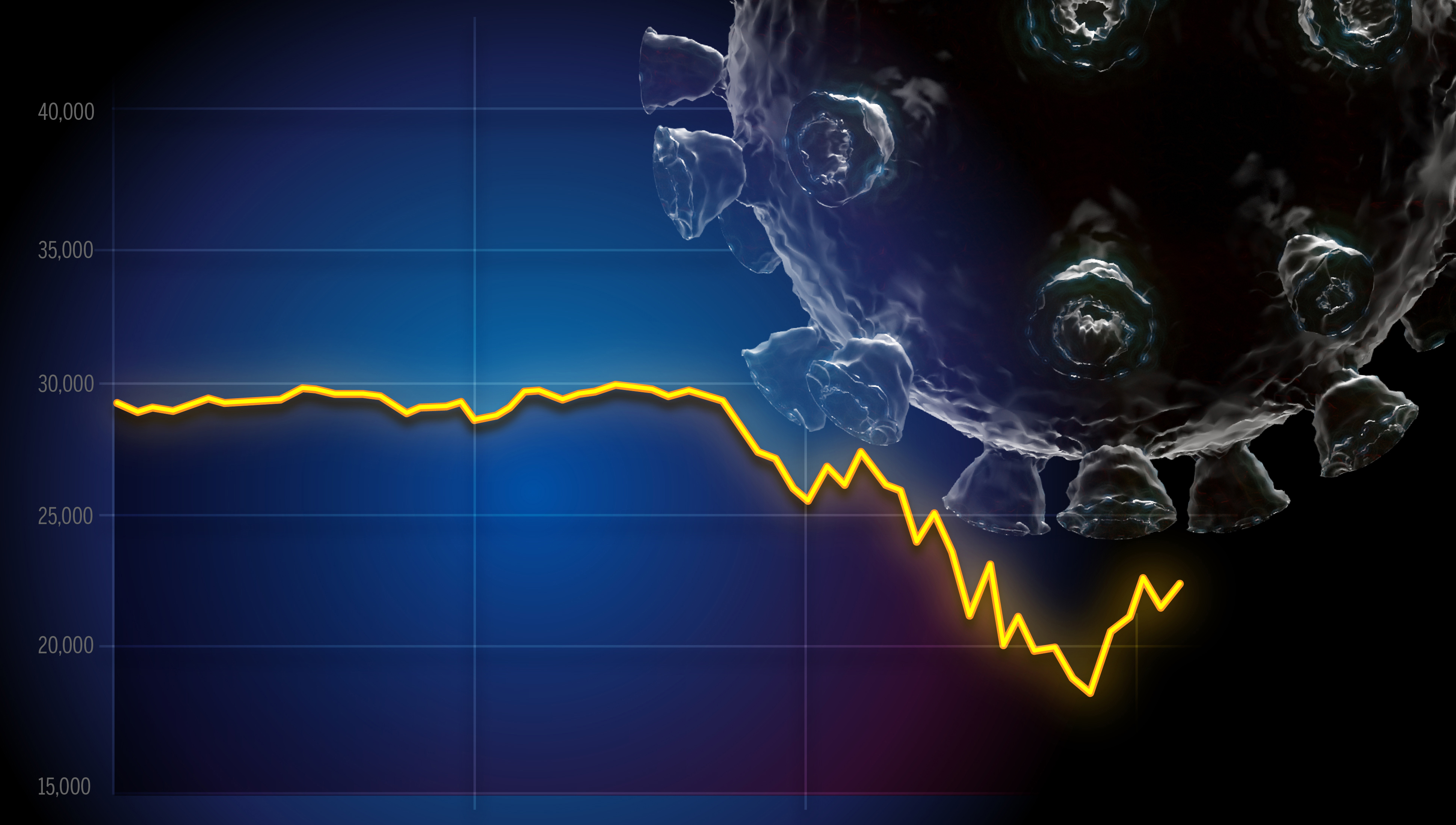

Corona was first considered a human health problem. But soon its economic and social implications also came to light. That is why the sudden disaster that befell the government in the last financial year 2019-20 to stabilize the economy came as a shock to them.

Protecting the lives of the people in these difficult times was the top priority of the government for which decisions and measures were taken which would minimize the impact on the lives and livelihoods of the people.

Prolonged lockdowns, nationwide shutdowns of business, travel restrictions and maintaining social distance have slowed economic activity, negatively impacting GDP growth and investment, and rising unemployment at the national level. Poverty increased further.

Corona virus, economic difficulties and government measures:

Here is a description of the immediate effects of the corona virus on Pakistan during the fiscal year 2019-20.

- Almost all industries and businesses were badly affected.

- The GDP declined by about Rs. 3,300 billion, reducing its growth rate from 3.3 per cent to 0.4 per cent.

- The overall budget deficit, which was 7.1 per cent of GDP, increased to 9.1 per cent.

- The reduction in FBR revenue is estimated at Rs. 900 billion.

- The federal government has reduced its tax revenue by Rs. 102 billion.

- Exports and remittances were severely affected.

- Unemployment and poverty increased.

In the financial year 2020-21, the government resolutely faced the socio-economic challenge and extended a helping hand to the weak and severely affected business class of the society to offset the negative effects of business shutdown and unemployment.

Economic measures to control coronavirus and other disasters:

In this regard, the government approved a stimulus package of more than Rs. A total of Rs. 875 billion was provided from the federal budget which was allocated for the following works:

- Rs. 75 billion has been allocated for procurement of medical equipment, protective clothing and medical sector.

- Rs 150 billion was allocated for 16 million underprivileged and poor families and shelters.

- 200 billion was allocated for cash transfer to those earning daily wages.

- Rs. 4.50 billion has been allocated for supply of items at discounted rates at utility stores.

- 100 billion was allocated to the FBR and the Ministry of Commerce to issue refunds to exporters.

- 100 billion has been allocated for deferred electricity and gas bills.

- The Prime Minister gave a special package for small businesses under which Rs. 50 billion was provided for the payment of 3 months electricity bill of about 3 million businesses.

- Farmers were given Rs. 50 billion for cheap fertilizers, loan waivers and other reliefs.

- 100 billion has been allocated for setting up an emergency fund.

- Rs.100 billion is for small and medium enterprises and other relief to the agricultural sector.

- Rs. 70 billion has been earmarked in the annual development budget for Corona projects.

This stimulus package increased the federal government's expenditure for which the federal government had to approve supplementary grants. The Finance Division arranged and disbursed funds to the concerned agencies, particularly Ehsas, USC, NDMA and FBR. The services rendered in implementing the stimulus package of these agencies were appreciated.

An Overview of Federal budget

- Economic growth rate will be increased from 0.38% to 2%.

- Budget deficit will be reduced from 9.6 percent of GDP to 7.2 percent.

- Inflation will be reduced from 11.3 per cent to 8 per cent.

- Foreign direct investment FDI will be increased by 25%.

The government has initiated structural reforms to improve transparency, efficiency and accountability in all key sectors.

The salient features of the Budget 2020-21 strategy are:

- Under the leadership of the Prime Minister, special measures and projects such as the Successful Youth Program, Health Cards, Billion Tree Tsunami, etc. have been protected.

- Continue the process of social expenditure under the Ehsas program to help the underprivileged and backward sections of the society.

- Maintaining a balance between Corona-related expenditures and fiscal deficits.

- Continue to assist the public in the next financial year to deal with the Corona devastation.

- Keeping the development budget at an appropriate level so that the goals of increasing economic growth can be met and employment opportunities can be created.

- Incentives for the construction sector, including resources allocated for the New Pakistan Housing Project.

- Steps are being taken to improve revenue collection without making unnecessary changes in taxes.

- Funds were also set aside for special areas, namely former FATA, Azad Jammu and Kashmir and Gilgit-Baltistan to ensure development and economic growth there.

- Significant importance has been given to the defense and internal security of the country.

- Austerity and reduction of unnecessary expenses will be ensured.

- Continuation of the IMF program.

- The NFC Award will be reviewed.

Financial measures to revive the economy

- Fundamental steps have been taken to provide financial resources to the people and the business community.

- The policy rate was significantly reduced by 5.25% from 13.25 to 8%.

- Business Payroll Loan 3% interest rate discount of 4% was given to avoid unemployment.

- For individual and business loans, banks have been allowed to lend an additional Rs 800 billion for which the credit limit has been increased.

- Payment of principal has been delayed for one year.

Economic scenario

According to a SBP report, the economy is facing uncertainty due to the Corona virus, which is heading towards the end of fiscal year 2020, due to difficulties on many economic fronts. Of greatest concern is the rapid spread of the disease. The number of patients is increasing day by day and it is becoming clear that the epidemic has not reached its peak.

This increased uncertainty is also reflected in a recent SBP survey. The May 2020 Consumer Confidence Survey showed a sharp deterioration in both consumer confidence and projected economic conditions. They improved in March 2020.

Similarly, overall business confidence was at its all-time low in April 2020. Importantly, Pakistan is not isolated in this regard as the global index of economic uncertainty was at an all-time high in April 2020. This shows that there is global uncertainty in the current situation.

However, there is a possibility of gradual improvement in economic activities going forward, as the government has kept the lockdown soft and activities in most sectors are continuing on a limited scale. This can lead to supply-side recovery.

Although locust heart attacks threaten the agricultural landscape, the kharif season could have adverse effects on production. However, achieving the target of 2.1% of real GDP during FY 2021 will require a parallel improvement in implication.

This will require efficient utilization of PSDP funds in the FY 2120 budget. SBP schemes are helping to meet the liquidity needs of both businesses and consumers. The high demand for these schemes shows that the corona virus As a result, economic actors are under severe pressure and increasing approvals are increasing liquidity aid, which will help limit the negative effects of the epidemic on supply and demand.

Financially, when the effects of the Corona virus began to show, the stability gained in the early part of last year was lost. During the fourth quarter of fiscal year 2020, spending increased and revenue growth slowed.

Therefore, it is estimated that the fiscal deficit for the fiscal year 2020-2021 will reach 9.0% of GDP, up from 4.0% in the fiscal year 2020 to July-March. Now that we have entered the fiscal year 2021, it is likely that government spending will continue to rise in the coming months as a result of the much-needed social and economic assistance package.

However, the gross revenue target of Rs 6.57 trillion for FY 21 is a test of courage, as it means that in an environment of low economic activity, significant growth will be required as compared to FY 20, as a large portion of revenue is expected.

Ongoing expenditures, such as interest payments and pensions, will require the government to adopt an effective debt management policy while ensuring that PSDP expenditures are budgeted for the fiscal year 2021.

Scenario of inflation

According to the analysis of Champs Write about SBP report, the inflation scenario is encouraging, but not without risks. Lower domestic demand in the coming months will help keep the general inflation-driven consumer price trend more soft and maintain inflation. As a result, inflation is expected to remain in the range of 7.0 to 9.0 percent during FY 2021. However, the recent rise in petrol prices has created the risk that inflation will move above these limits.

Although lower global demand may keep international oil prices low in the coming months, OPEC members agreeing to a major cut in oil supplies could jeopardize both inflation and expectations for the future. In the same way, further locust heart attacks or a disruption in the coronavirus supply chain could damage food security, leading to higher inflation.

0 Comments